Click here to Download the Tax Computed Sheet +Individual Salary Sheet+Automatic Arrears Relief +HRA Calculator + Form 16 Part A&B and Part B for the Financial Year 2013-14

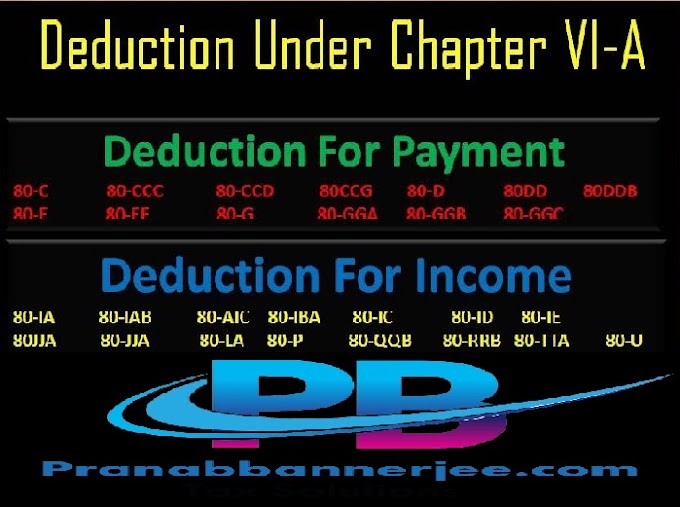

DEDUCTION UNDER CHAPTER VI-A

80 CCG): Rajiv Gandhi Equity Savings Scheme Amount of deduction –The amount of deduction is at 50% of amount invested in equity shares/units. However, the amount of deduction under this provision cannot exceed Rs. 25,000.

Section 80D :- Deduction in respect of health insurance premia paid, etc.Max limit Rs.15,000/- for below60 Years and Rs. 20,000/- for Sr.Citizen

Section 80DD :-incurred any expenditure for the medical treatment (including nursing), training and

rehabilitation of a dependant, being a person with disability

Section 80 U :- Deductions in respect of a person with disability (section 80U):

Under section 80U, in computing the total income of an individual, being a resident, who, at

any time during the previous year, is certified by the medical authority to be a person with

disability, there shall be allowed a deduction of a sum of fifty thousand rupees. However,

where such individual is a person with severe disability, a higher deduction of one lakh rupees

shall be allowable.

Section 80DDB :-Section 80DDB allows a deduction in case of employee, who is resident in India,

during the previous year, of any amount actually paid for the medical treatment

of such disease or ailment as may be specified in the rules 11DD (1) for himself

or a dependant. The deduction allowed is equal to the amount actually paid or

Rs. 40,000 whichever is less. Further the amount paid should also be reduced by

the amount received if any under insurance from an insurerer or reimbursed by

an employer. I case of a senior citizen (an individual resident in India who is of the

age of sixty years or more at any time during the relevant previous year)

the amount of deduction allowed is Rs. 60,000/-.

Deduction in respect of interest on loan taken for higher education (Section 80E):

Section 80E allows deduction in respect of payment of interest on loan taken from any

financial institution or any approved charitable institution for higher education for the purpose

of pursuing his higher education or for the purpose of higher education of his spouse or his

children or the student for whom he is the legal guardian.

Deduction in respect of interest on loan taken for residential house property (Section 80EE):

Vide Finance Act 2013, an individual is allowed a deduction upto a limit of Rs 1,00,000 being

paid as interest on a loan taken from a Financial Institution, sanctioned during the period 01-04-

2013 to 31-03-2014 (loan not to exceed Rs 25 lakhs) for acquisition of a residential house

whose value does not exceed Rs 40 lakhs. However the deduction is available if the assessee

does not own any residential house property on the date of sanction of the loan.

(Section 80G): -

Section 80G provides for deductions on account of donation made to various funds , charitable

organizations etc. In cases where employees make donations to the Prime Minister’s National

Relief Fund, the Chief Minister’s Relief Fund or the Lieutenant Governor’s Relief Fund

through their respective employers, it is not possible for such funds to issue separate certificate

to every such employee in respect of donations made to such funds as contributions made to

these funds are in the form of a consolidated cheque. An employee who makes donations

towards these funds is eligible to claim deduction under section 80G. It is, hereby, clarified that

the claim in respect of such donations as indicated above will be admissible under section 80G

on the basis of the certificate issued by the Drawing and Disbursing Officer (DDO)/Employer

in this behalf - Circular No. 2/2005, dated 12-1-2005.

No deduction under this section is allowable in case of amount of donation if exceeds Rs

10000/- unless the amount is paid by any mode other than cash.

Deductions is respect of rents paid (Section 80GG):

In this Section will be entitled to a deduction in respect of house rent paid by him in

excess of 10% of his total income. The deduction shall be equal to 25% of total

income or Rs. 2,000/- per month, whichever is less. The total income for working out these

percentages will be computed before making any deduction under section 80GG.