As the New Finance Budget 2015 has already declare the Income Tax Slab have not changed and same as past Financial Year, but some changes have been made and raised some maximum limit of some Tax Section in this Financial Year 2015-16.

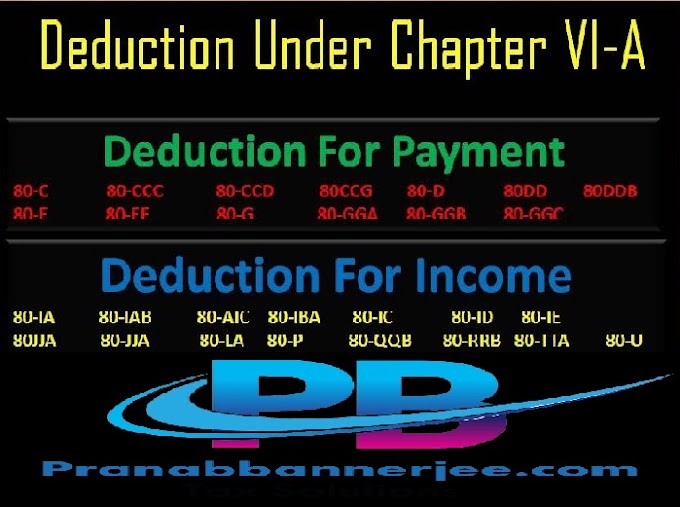

1) The Income Tax Section 80 D Raised up to Rs. 25,000/- for general and up to Rs. 30,000/- for Sr.Citizen.

2) A new deduction U/s 80C have introduce in this Finance Budget 2015 in the name of Sukanya Samriddhi Scheme Account which is Max Limit Rs. 1,50,000/-.

3) The Section 80CC have also raised up to Rs. 1,50,000/- in this Finance Budget 2015 for Pension Account.

4) Transport/Conveyance Allowance is double up to Max Rs. 1600 P.M.

5) Tax Rebate Rs.2,000/- U/s 87A and Savings Bank Interest up to Rs. 10,000/- U/s 80TTA will be continue in the Financial Year 2015-16.

In Future it will be indispensable the Arrears Relief Calculator, as the Central Govt and other some State Govt have already arrange to set the 7th Pay Commission to the Govt employees. In this Regard it may helpful to calculate the Arrears Relief of Salary which can calculate by the Income Tax Section 89(1) for Relief of Arrears.

Up to Date Arrears Relief Calculator U/s 89(1) Since the financial year 2000-01 to Financial Year 2015-16 with Form 10E. Also it is prepared the Income Tax Calculator for the Financial Year 2015-16 as per the New Finance Budget 2015.

You can easily Calculate your Tax Liability by this Excel Based Software for the Financial Year 2015-16.