As

per the Central Finance Budget 2015, it is clear that the Tax Slab

have not changed, but some of the limit of Tax Section has hike and one

more deduction has include U/s 80C in the name of Sukanya Samriddhi

Account.

As

the financial Year 2015-16 and Assessment Year 2016-17 is just now

started and the Advance Tax will be paid for this financial year very

shortly. So it is necessary to calculate your Tax Liability

for the Financial Year 2015-16.

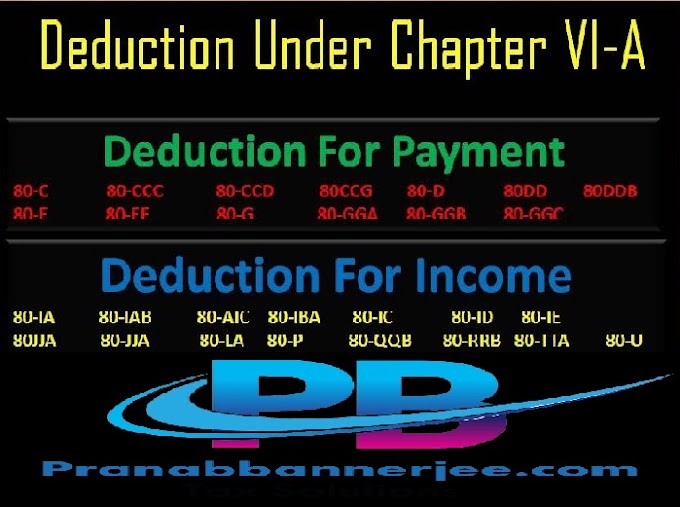

Most of the tax changes is given below for the Financial Year 2015-16 :-

- Section 80D is hike the max limit Rs. 25,000/- for below 60 years and Rs.30,000/- for Sr.Ctzn.

- Section 80U has raised the Max limit Rs. 25,000//-

- Section 80DDB hike the Max Limit Rs. 80 thousand

- Section 80 the Travelling Allowances has hike the Max Limit Rs. 19200/- P.A.

- Section 80CCC has hike the Max Limit Rs. 1.5 Lakh as the previous year's was Rs. 1 Lakh

The itaxsoftware.net has

prepared a Excel Based Advance Tax Calculator for Govt and Non Govt

employees for the Financial Year 2015-16 and Assessment Year 2016-17

with the Automated Arrears Calculator with Form 10E since FY 2000-01 to

2015-16 and Automated House Rent Exemption Calculation U/s 10(13A). This

Excel Utility can use both are Govt and Non-Govt employees with Salary

Structure.

|

| Salary Structure |

|

| Tax Compute Sheet |

|

| Arrears Relief Calculator |