Download All in One TDS on Salary for Non-Govt employees for the FY 2015-16 and AY 2016-17 [ This Excel Based Software can prepare at a time your Tax Compute sheet + Salary Structure + Individual Salary sheet + Automatic HRA Calculation + Automatic Form 16 Part B and Part A&B + 12 BA]

The Union

Budget for 2015 was presented today by Arun Jaitely.The tax slabs have remain

unchanged but there have been some changes in terms of Transport Allowance,

Medical Insurance benefits and exemption for Physically challenged tax payers.

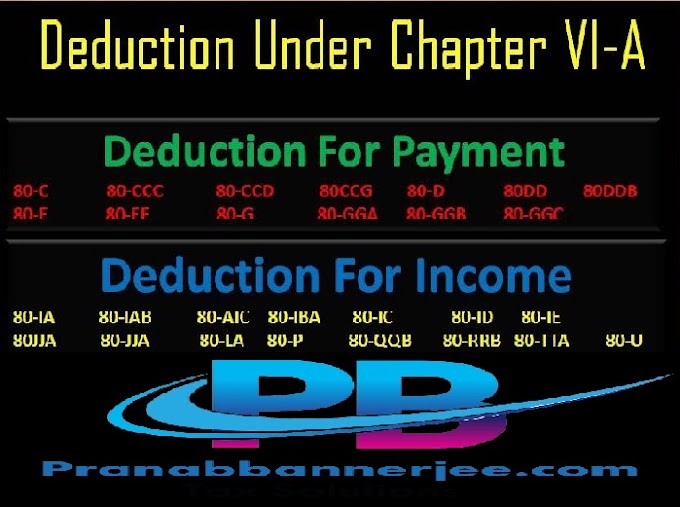

Budget 2015: Changes

We have incorporated the 7

changes that happened in Budget 2015 (presented on February 28, 2015)

1.

Transport Allowance increased to Rs 1,600 from Rs 800

2.

Increase in Medical Insurance Premium

exemption limit from Rs 15,000 to Rs 25,000 u/s 80D (up to 30K for Senior

Citizens)

3.

Sukanya Samriddhi Account a new investment option u/s 80C

4.

Very Senior

Citizens (above 80 Years of age) to be allowed deduction of Rs 30,000 for

medical expenditure in case they do not have health insurance

5.

Additional exemption of Rs 50,000 under sec 80CCD for investing in NPS (New Pension Scheme)

6.

Increase in the limit of deduction available for treatment of

chronic diseases u/s 80DDB from

Rs 60,000 to Rs 80,000

7.

Rs 25,000 increase in deduction available to persons with

disability and severe disability u/s 80DD and 80U