The

below given Excel Based Software which can prepare at a time 100

employees Form 16 Part A&B for the Financial Year 2015-16 and

Assessment Year 2016-17. As per the Finance Budget 2015-16 have already

hike the limit of some Tax Section, but no changes the Tax Slab which is

same as per the Financial Year 2014-15 and Assessment Year 2015-16.

By

this unique Excel Software you can calculate your Tax Liability for the

Financial Year 2015-16 and you can prepare at a time Form 16 Part

A&B which you can keep this in future and distribute in the end of

the Financial Year 2015-16. It also you can change the period of

financial year in this Excel Utility. So you can gain and reduce your

time for prepare the Form 16 as this prepare Advance in this time.

Some

of employees can goes to another Concerned and leave his present

working concerned in the middle of the Financial Year, then you must to

give the Form 16 to the leaving employees in the middle in the Financial

Year. In this regard in this Excel Utility have the facility for

changes the Period of Financial Year 2015-16.

For

an example :- Mr. A working in the ABLtd. and Mr. A leave the ABLtd. in

the month of June 2015 and joined the another Concerned BC Company.

Hence the Deductor of AbLtd may give the Form 16 to Mr. A up to his

working period in this Concerned.

This

Excel Utility Can prepare at a time 100 employees Form 16 Part A&B

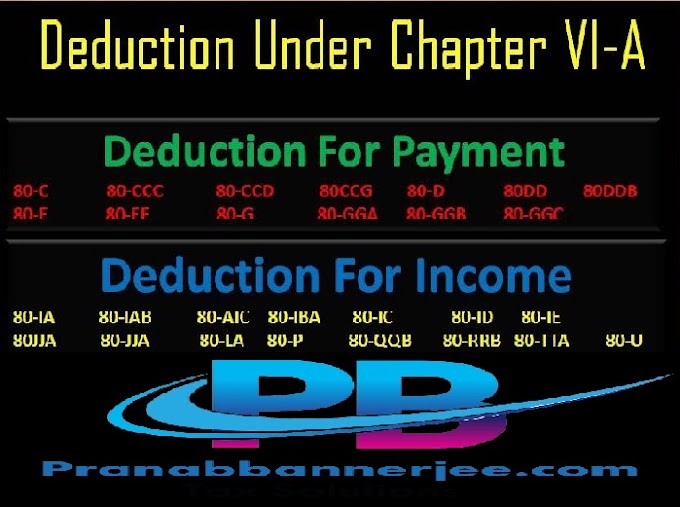

for the Financial Year 2015-16 and all the amended Tax Section as per

the Finance Budget 2015.

Main feature of this Utility:-

- Auto Calculate the Income Tax for the Financial Year 2015-16 as per Finance Budget 2015-16

- Prepare at a time Form 16 Part A&B with all amend limit of Tax Section

- You can change the Financial Year at any time if you have to need the changes

- Automatic Convert the Amount in to the In Word

- Prevent the Double entry of Pan Number and Name of Employee

- This Excel Utility can use both of Govt and Non Govt Concerned

- Easily Generate and Easy to install in any Computer