Download Automatic Form 16 Part B for Financial Year 2015-16 and Assessment Year 2016-17. Most of the Govt and Non-Govt Concerned have yet not prepared the Form 16 Part B for the Financial Year 2015-16. As per the CBDT Circular that the Form 16 Part A must be download from the Income Tax TRACES PORTAL www.tdscpc.gov.in and the Part B must be prepared by the Employer. The Financial Year 2015-16 have already past and the Income Tax Return Filling last dated is 31st July 2016. In this regard, the Form 16 Part B must be prepare and given to the concerned employees , so they can fill the Income Tax Return in due time.

Some of the Concerned have already prepared the Form 16 Part B for F.Y.2015-16, but most of the Concerned have yet not prepared the Form 16 Part B for F.Y.2015-16.

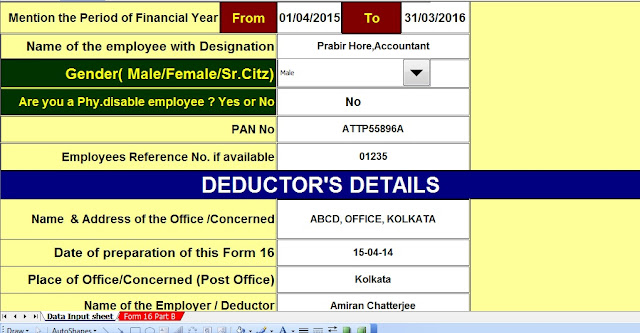

Below given an Excel Based Software which can prepare the Automated Form 16 Part B ( One by One).This Excel Utility most useful in that Concerned where the number of employees not more than 20 or 30.

Feature of this Excel Utility :-

1) This Excel Based Software can prepare One by One Form 16 Part B for F.Y.2015-16

2) Automatic Calculate the Income Tax liability as per the Income Tax Slab for F.Y.2015-16

3) Easy to install just like an Excel File

4) Automatic Calculate the House Rent Exemption Calculation U/s 10(13A)

5) Automatic Convert the Amount into the In-Words( without any Excel Formula)

6) All the Income Tax Section have in this Software

7) This Software can use both of Govt and Non-Govt Concerned.