Due to Demonetization and government drive against black money, a lot of Income Tax rules are either amended or changed with change in financial bills. Here are the list of major Income tax rules which are changed and implemented by next financial years are :

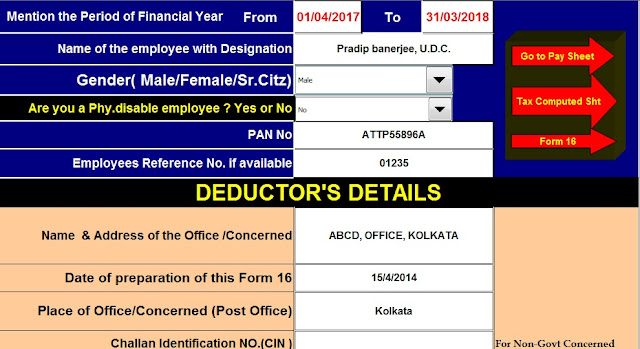

Download Automated All in One TDS on Salary for Govt. & Non-Govt. Employees for F.Y.2017-18.[ This Excel Utility can prepare at a time Individual Tax Computed Sheet + Individual Salary Sheet + Individual Salary Structure + Automated H.R.A. Exemption Calculation U/s 10(13A) + Automated Arrears Relief Calculator with Form 10 E up to date version + Automated Form 16 Part A&B and Form 16 Part B for F.Y. 2017-18 ]

Change in Income Tax Slabs for F.Y.2017-18 as per Finance Budget 2017

Tax rebate under 87A changed. Rebate under Section 87A gets reduced from Rs. 5,000 to Rs. 2,500. No further rebate will be applicable for taxpayers having income above Rs. 3.5 lakh.

This means tax savings of up to Rs. 7,700 for those with a taxable income between Rs. 3 lakh and Rs. 5 lakh. Where as tax saving odf Rs 12,900 for persons with taxable income between Rs. 5 lakh and Rs. 50 lakh.

Calculate &Download Income Tax Calculator ( All in One) FY 2017-18 in Excel For All State Government Employees

2) Individual having income more than Rs 50 lacs to Rs one crore , A surcharge of 10% will be charged. Where as existing surcharge of 15 per cent will remain the same for individuals having income above Rs. 1 crore.

Download Automated All in One TDS on Salary for Non-Govt Employees for F.Y.2017-18. [ This Excel Utility can prepare at a time Tax Computed Sheet + Individual Salary Structure + Automated Form 12BA + Automated H.R.A. Exemption Calculation + Automated Form 16 Part A&B and Form 16 Part B with new Income Tax Slab for F.Y.2017-18

3) A simplified Income tax return form for person having only salary income. This return form will be utilized for individuals having a taxable income up to Rs. 5 lakh other than business income.

4) RGESS (Rajiv Gandhi Equity Saving Scheme) discontinue from Assessment Year 2018-19. No deduction will be allowed for investment in RGESS.

5) Introduction of Penalty for non filling Income Tax returns – Income Taxpayers who do not file their returns on time will have to shell out a penalty of up to Rs. 10,000 from Assessment Year 2018-19. However, if the total income of the person does not exceed Rs. 5 lakh, the fee payable under this section shall not exceed Rs. 1,000.