In the financial year, 2019-20 has corrected the arrangement of Form 16 by the CBDT (Focal Leading body of Direct Taxes) that is the 'pay TDS authentication." This new Format can break the tax-vindicated rewards in nuances that the region unit paid to the delegate and isolated from this, the full tax breaks that region unit proclaimed by the taxpayers.

Pay TDS Authentication Told Date and once it happened. The CBDT told the new organization of Form16 accompanies the impact from the long stretch of April '2019.

Fundamental supplant are made inside the new organization of the Tax Return?

The new arrangement of Form16 offers full nuances of the settlements actually like the house rent reward U/s 10(13A), Travel concession or helps beneath section 10(5).

It is noticed that according to the new Financial plan 2020 the Money Priest has presented a New Section 115 BAC just as presented a new arrangement of Annual Tax Estimation based on New and Old Tax Regime under this part. Presently it is important to make out what is the New and old Tax Regime?

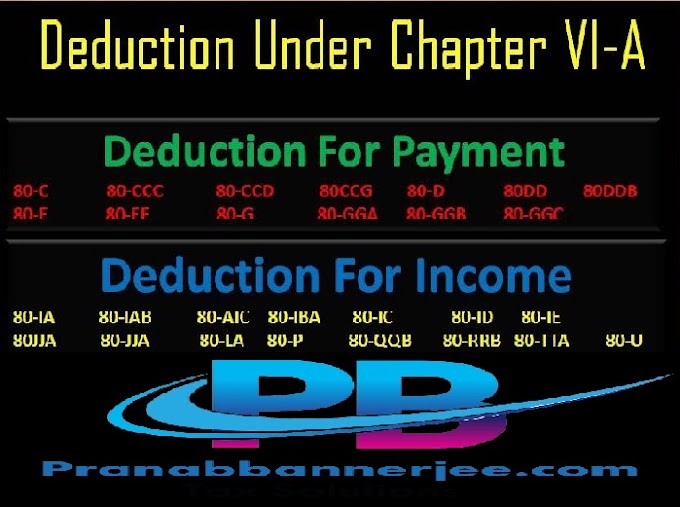

1) In the New Tax Regime, you can not profit from any Annual Tax Areas benefits with the exception of NPS benefits. And furthermore profited in the new Tax Chunk just for the New Tax Regime.

2) In the Old Tax Regime, you can profit from every one of the Tax Segments benefits yet the Tax Section will be the Old Tax Chunk according to the Financial Year 2019-20. In this Spending plan, unmistakably you will give an alternative according to your decision as the new and old tax regime in the Endorsed Form No 10-IE

Presently pick your necessary Annual Tax Form 16 Readiness Dominate Based completely robotized Programming according to the New and Old Tax Regime U/s 115 BAC from the underneath

Hope you have to need the below given Income Tax Preparation Excel Based Auto-fill Form 16 for the Financial Year 2020-21 and The assessment Year 2021-22

Or on the other hand

Or on the other hand

Or