Top 10 Ways to Save Taxes for F|Y 2021-22 |The government has provided many additional ways to save taxes for the salaried class. Of all the ways to save tax, I have listed the best ways to save tax.

1. Use the HRA discount effectively

HRA (house rent allowance), an allowance paid with the salaries of government and private employees| This allowance is to cover the actual cost of rent| The income tax department gives tax benefits on this allowance. It does not consider the entire amount as taxable income|

To get the benefit of maximum duty on HRA, your HRA should be kept at 50% of basic salary and the rent paid should be 20% more than HRA |

2. Buy a dream home with a home loan |

As a salaried person, you can buy a house and enjoy tax savings on a home loan. That way, you can own your dream home and get tax benefits|

So, if you have a home loan, you can save tax under three categories, e.g. 80C, 24 and 80EEA|

Discount on payment of the principal amount

Home loans are eligible for tax deduction up to Rs. 1.5 Lakh in EMIs.

Discount payable on home interest|

You can also claim an interest tax deduction on a home loan 24/24. The limit of this discount is Rs 2 lakh|

Discount facility for first-time buyers

First-time buyers have a third tax benefit for U/s 80 EEA| This discount of Rs 1.5 lakh is available on home loan interest| This discount limit exceeds the above-mentioned discounts by Rs. 1.5 lakhs and Rs. 2 lakhs|

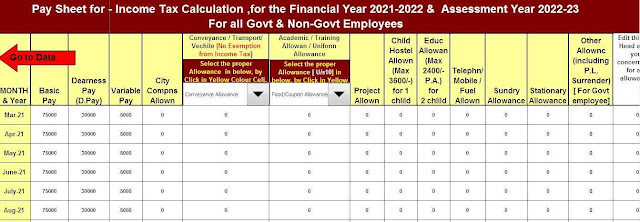

You may also, like- Automated Income Tax Preparation Excel Based Software All in One for the Non-Govt (Private)Employees for the F.Y.2021-22[This Excel Utility can prepare at a time your Tax Computed Sheet + Individual Salary Structure as per Non-Govt Employees Salary Pattern + Automated Form 12 BA + Automated Income Tax Form 16 Part A&B and Form 16 Part B for the F.Y.2021-22]

3. Life insurance premium

You are a LIC. Take policy for both your family savings and financial security. A term plan brings no maturity benefit but it does have a high mortality benefit|

4. Ensure retirement pension through NPS

This scheme is only for a retirement scheme. Anyone including salaried persons can invest in this scheme| You need to invest in your service time. A portion of your contribution also goes to shares and bonds|

Upon retirement, you will receive a single-digit amount. Some amount of money is used to give you a regular pension|

Let us look at how a taxpayer can save tax through NPS-

Employee contribution to NPS account u / s 80CCD (1)

Investments in your NPS account are tax-deductible up to Rs 1.5 lakh.

Employer's Contribution to NPS Account u / s 80CCD (2)

The employer's contribution to your NPS account is also eligible for a tax deduction. However, the maximum contribution should be 10% of your salary. The limit for central government employees is 14%.

Additional contribution to NPS account U / s 80CCD (1B)

In addition to the contributions above, you can deposit additional amounts into your NPS account. And can get additional tax benefit up to Rs 50,000. This discount is available only if you invest more than the prescribed amount. As you know employees have to contribute 10% of their salary. The extra amount is eligible for this discount.

5. In the PPF invest for children's education and marriage

This is a profitable social savings scheme of the Government of India. The PPF project is designed for long-term savings. So you can also use it for your kids higher education and marriage.

PPF account matures within 15 years.

It gives you an interest rate of 7.9%, higher than Bank FD.

PPF saves your taxes in three ways. It is covered by EEE tax bracket.

• Thus, up to 1.5 lakh, U/s 80C is eligible for a tax deduction for your investment.

The amount of interest credited to your PPF account and the amount of maturity U/s 10 (11) are completely exempt from tax.

6. Health insurance for hassle-free treatment

Like life insurance, the government also gives you tax breaks on health insurance. So, invest in any health project for hassle-free treatment and you will get the benefit of duty U/s 80D. This section gives you the opportunity to save up to Rs. 20,000 in taxes. 1 lakh rupees. Let's see-

You can claim a 25,000 discount if you and your family (including children) pay a premium against the health policy|

If you include your dependent parents with your family, the discount limit is Rs. 50,000

• Discount may be Rs. 75,000, if your parents are senior citizens. So, Rs 25,000 for you and your family and an additional Rs 50,000 for your parents.

7. Use children's tuition fees for tax breaks

You can save tax by paying your two children's tuition fees up to Rs.1.5 to 80C. Note that this discount is available for fees paid to educational institutions from pre-primary to higher education| However, for this discount, you have to fulfil some conditions-

8. Create resources through ELSS

Equity Linked Savings Scheme, as its name suggests, is a type of mutual fund. It invests 80% of its funds in shares. ELSS is not only an authentic investment product but also a most flexible option.

ELSS gives you a discount of Section 80 over Rs 1.5 lakh.

9. Save for the girl child through the Sukanya Samrudhi project

Sukanya Samridhi Yojana, a government-sponsored savings scheme for the upliftment of girls, through regular investment in this scheme, can create a large fund. And you can use it for your daughter's education and wedding. You can also avail of tax exemption up to Rs 1.5 Lakh through SSY. Maturity is also tax-deductible.

You need to be aware of some conditions to get the benefit of tax exemption-

You can open an account at any bank or post office with a nominal amount of Rs.500 / -. 250

• The more you deposit, the more funds you will have.

The girl needs to open an SSY account before the child is 10 years old. This is a long term investment.

It gives an 8.4% interest rate. This is a very good interest rate compared to other savings schemes.

10. Some charitable work U/s 80G

Do some charity after taking advantage of all the savings schemes. However, don't worry; it's worth saving for you too| Government relief funds, political parties, religious organizations and other registered organizations can claim tax breaks for charities and donations for u / s 80G|

However, the discount limit under this category depends on the different types of organizations where you do charity. For example, a grant from the Prime Minister's National Relief Fund is eligible for a 100% operation. On the other hand, the Prime Minister is eligible to manage 50% of the grant to the Drought Relief Fund.

Please note: The total discount u / s 80C (including discount U / s 80CCC and 80CCD) up to 1.5 is allowed for all savings schemes covered under these categories.

[This Excel Utility can prepare at a time your Tax Computed Sheet + Individual Salary Structure as per Govt and Non-Govt Employees Salary Pattern + Automated Income Tax Arrears Relief Calculator U/s 89(1)with Form 10 E for the F.Y.2021-22 + Automated Income Tax Form 16 Part A&B and Form 16 Part B for the F.Y.2021-22]