The

Financial Year 2015-16 has already started and as per the Finance

Budget 2015, the Tax Slab have not changed, same as previous financial

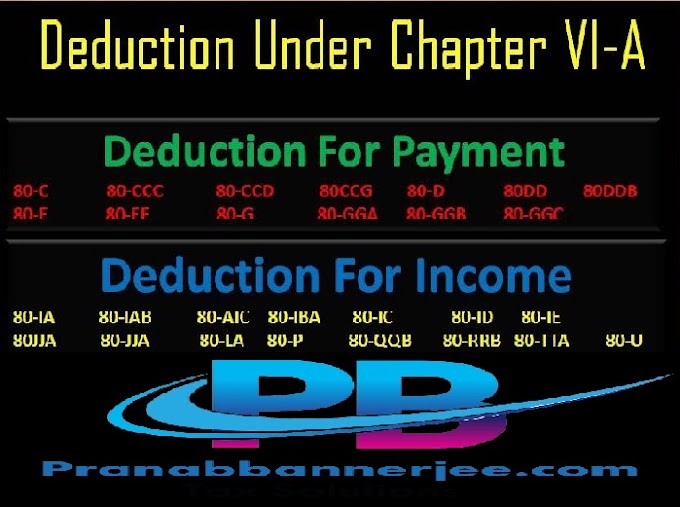

year 2014-15. But Limit of some Tax Section has Increased by this

Finance Budget. The Section 80U have increased 75000/- P.A. and Rs.

125000/- P.A. for Blind persons. Traveling Allowances also raised up to

1600/- P.M. and Blind Person can avail Rs. 3200/- P.M. Section 80D

Raised Rs. 25000/- and Sr.Citizen Rs. 30,000/-

It

is necessary to calculate your Tax Liability for the Financial Year

2015-16 as the D.A. has also increased to the Govt employees time to

time.

The below given Excel based Software which can prepare at a time Income Tax Computed Sheet + Automatic Arrears Relief Calculator + Automatic House Rent Exemption calculation + In built Salary Structure for both Govt & Non Govt employees which prepared on the basis of Salary Pattern of each Govt and Non Govt concerned + Automated Form 16 Part A&B + Automated Form 16 Part B for the Financial Year 2015-16 and Assessment Year 2016-17.

It

is most hazard to calculate individually HRA Calculation separately

another sheet and also it is hazard to calculate the Arrears Relief

Calculation from the financial Year 2000-01 to 2015-16. This Excel

Utility can prepare all the calculation just a moment. Thus your time

may reduce for calculating the actual Income Tax of each employee.

This Excel Based Software Can prepare more than 500 employees Tax Computed One by One.

Feature of this Utility:-