Tax Planning for the F.Y.2021-22 A.Y.2022-2023

There are certain investments and expenses under Section 80C of the Income Tax Act which helps the taxpayer to reduce tax liability.

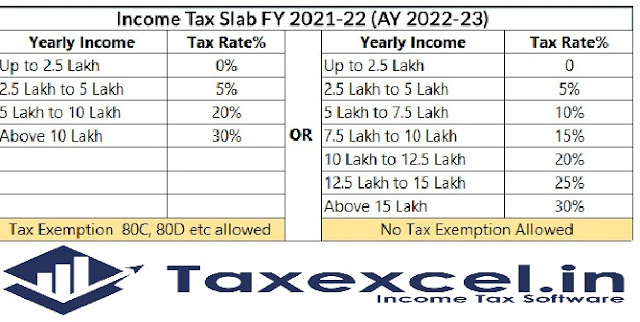

If you want to continue existing or outdated tax discipline while filing your Income Tax Return (ITR) for F.Y 2020-21, you can avail several exemptions under the Income Tax Act, 1961. However, to be sure, you must Assume that you have compared the taxes payable under the old and new tax systems.

Initially, the old tax duty includes 4 basic income tax exemptions for the taxpayer for tax assessment and earnings for the assessment year 2021-22. In addition to Section 80C, the taxpayer has a few more exemptions.

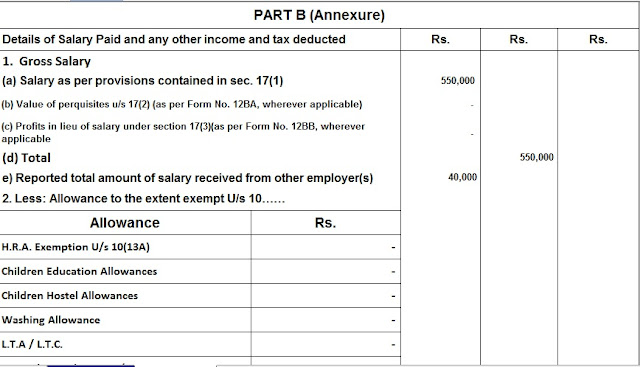

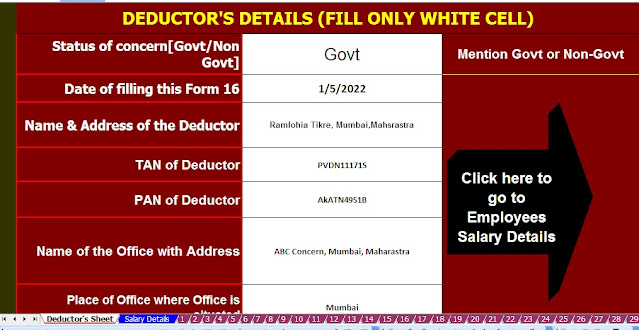

Download Automated Income Tax Revised Form 16 Part A&B for the F.Y.2020-21 with the new and old tax regime [This Excel Utility can prepare at a time 50 Employees Form 16 Part A&B]

Tax benefits under section 80C

Some investment under Section 80C of the Income Tax Act which helps the taxpayer to reduce the tax payable. However, the maximum limit is up to Rs 1.5 lakh per annum which can be in any of these investments or expenses. Fixed investments include five-year notified tax-savings bank deposits, life insurance premiums, Employees Provident Fund(EPF), Public Provident Fund (PPF), National Savings Certificate (NSC), Senior Citizen Savings Scheme (SCSS), Equity Linked Savings Scheme. (ELSS). There is also an 80C tax benefit on home loans (principal amount) for EMI providers. Children's tuition fees paid as school fees fall under section 80C.

Tax benefits under section 80D

The premium paid for health insurance brings a tax benefit. The premium can be purchased as a separate plan, family floater plan, critical illness plan as a separate plan or as a rider from life and in favor of health insurance providers or general insurance companies.

Currently, the limit for those under the age of 60 is Rs 25,000. This includes self, wife and children and the health cover can be Mediclaim, Family Floater, Critical Illness etc. The premium paid for any of these projects will be deducted from the total income under section 80D. The limit is Rs 50,000 for those above 60 years of age. If both the individual taxpayer and the parent are over 60 years of age, the exemption can be taken up to Rs one lakh. Any payment up to Rs 5,000 for a preventive health check-up is also eligible for tax benefits but it has to be within the overall limit.

Download Automated Income Tax Revised Form 16 Part A&B for the F.Y.2020-21 with the new and old tax regime [This Excel Utility can prepare at a time 100 Employees Form 16 Part A&B]

National pension system tax savings

Section 80 CCD (1): Under Section 80 CCD (1), the employer and the employee can contribute to NPS. The discount should not exceed 10 % of the basic salary, except for all other allowances and permits. In the case of self-employment, under 80 CCD (1) of the Income Tax Act, 20 per cent of the total income contribution can be deducted from the taxable income, subject to a ceiling of Rs 6,000. 1.50 lakh under 60 CCEC.

Section 80CCD (1B): Under Section 80CCD (1B), the taxpayer will be allowed a rebate of ৫০ 50,000 for either employee or self-employed NPS. Exemption under Section 80CCD (1B) is exempt from exemption under Section 80CCD (1), but the same amount cannot be claimed under both sections.

Download Automated Income Tax Revised Form 16 Part B for the F.Y.2020-21 with new and old tax regime [This Excel Utility can prepare at a time 50 Employees Form 16 Part B]

Section 80 CCD (2): Salary employees get tax benefit on the employer's contribution to his or her NPS account. Contribution of ten per cent of the employer's salary (Basic Plus Dearness Allowance) may be claimed as exemption from taxable income under Section 80CCD (2) of the Income Tax Act, 1961. There is no high cap on the amount of this tax deduction. This exemption exceeds the ceiling limit of Rs 1.5 lakh given under Section 80C and the limit of Rs 50,000 under Section 80CCD (1B). Under the new tariff system, benefits under section 80CCD (2) are still available for the benefit of taxpayers.

Education loan repayment

When higher education is for higher education, tax income on interest paid in an educational institution qualifies for an income tax deduction.

The interest earned on higher education is exempt from gross income under Section0EE, there is no financial ceiling on that interest that can be claimed as a discount. In order to educate yourself, your child or even your spouse, you should take it from a financial institution or an approved educational institution. This waiver will be granted at any time prior to the year of initial assessment and the seven immediate assessment years until the initial assessment year is successful or full interest is claimed.

Download Automated Income Tax Revised Form 16 Part B for the F.Y.2020-21 with new and old tax regime [This Excel Utility can prepare at a time 100 Employees Form 16 Part B]