What are the latest income tax slab rates after the 2020 budget of F.Y 2021-22 & A.Y 2022-23? Are there any changes in the tax rates applicable to individuals? Let us see the details.

Key Highlights of the 2021 Budget

# EPF's contribution above Rs 2.5 lakh is taxable!!

This will continue from 1st April 2021, with interest on any deposition more than Rs. 2.5 lakh by an employer from an approved recruiting fund is taxable under the provisions of Bill 2021. This also includes employee EPF and VPF contributions.

# The Income Tax Slab Rate is the same as the previous financial year 2020-21, slab no changes

Yes, the income tax slab rate has not changed from what it was last year. Even in the case of mutual funds, there is no change. "Mutual Fund Taxation F.Y 2021-22 & A.Y 2022-23.

No changes have been made to your tax saving options, such as # Sec.80C

Even in the case of tax saving options, there is no change in the limits of 80C or other sections.

You may also, like- Prepare at a time 50 Employees Form 16 Part B for the F.Y.2020-21 as per new and old tax regime U/s 115 BAC

# No one is required to file an income tax return if he is 75 years of age or older

Those whose life expectancy is 75 years or more are now exempted from filing income tax. But keep in mind that this benefit includes income for them like pension and interested income.

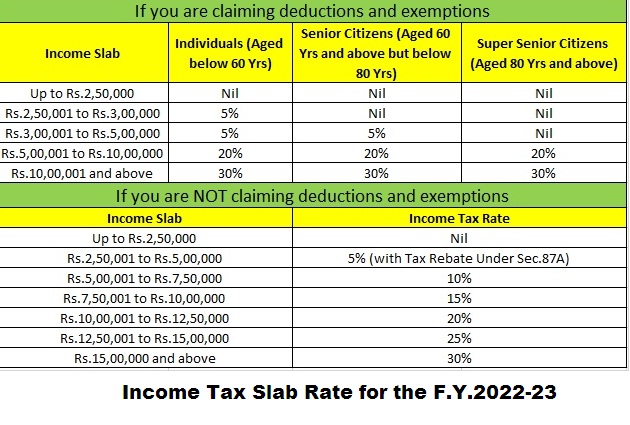

Financial Income for F.Y. 2021-22 & A.Y 2022-23 Latest Income Tax Slab Rate

This 2021 budget does not propose any change in the income tax slab rate. Thus, the old rates will continue for F.Y 2021-22 or A.Y 2022-23

Here are the two types of tax slabs rate.

1. For those who want to claim IT deduction and discounts.

2. For those who do not want to claim IT discounts and discounts.

I explain both slabs as below.

You may also, like- Prepare at a time 50 Employees Form 16 Part A&B for the F.Y.2020-21 as per new and old tax regime U/s 115 BAC

Now, if you want to choose the new tax discipline, you need to forget the deduction or discounts below.

(i) The travel concessions included in section (5) of section 10;

(ii) The house rent allowance included in section (13a) of section 10;

(iii) Certain allowances contained in section (14) of section 10;

(iv) Allowance for MPs / MLAs as per Section 10 (17);

(v) The income allowance of minors included in section (32) of section 10;

(vi) Deduction of SEZ units under Section 10AA;

(vii) Standard exemption, including entertainment allowance and the exemption for employment / professional tax

(viii) H.B.L. Interest U/s 24 (B) Max Rs. 2 Lakh.

(Loss of principal income from the home property for the rented house will not be allowed to be left under anyone

Other heads and will be allowed to proceed in accordance with customary law);

(ix) additional depreciation under section (iia) of sub-section (1) of section 32;

(x) Exemptions under sections 32AD, 33AB, 33ABA

(xi) Subsection (ii) or various exemptions for grants or expenditures for scientific research contained in sub-section

(iia) Or sub-section (iii) of paragraph (1) or section (2AA) of 35;

(xii) Exemption under section 35AD or section 35cc;

(xiii) Exemption from family pension under section 57 (iia);

(xiv) Any waiver under Chapter VIA

You may also, like- Prepare at a time 100 Employees Form 16 Part B for the F.Y.2020-21 as per new and old tax regime U/s 115 BAC

80EEB, 80G, 80GG, 80GG, 80GGC, 80AI, 80-IAB, 80-IAC, 80-IB, 80-IBA, etc.). However, under the deduction U/s 80

80. Sub-section (2) of the CCD section (Employer's contribution to the employee's account in the notified pension scheme) and

Section 80JJAA (for new employment) may be claimed.

However, there are some discounts that you can still claim using the new tax charges and they are below.

1. Retirement benefits, gratuity etc.

2. Transportation of pensions

3. Leave encryption in retirement

4. Return compensation

5. VRS facility

6. EPFO: Employer's Contribution

7. NPS withdrawal facility

8. Scholarship

9. Awarding prizes established in the public interest

Which one will you use for maximum tax benefit?

It’s still not clear and so it’s hard for me to say anything briefly. However, going by the changes, I assume it becomes different from the individual. Therefore, you need to calculate from yourself and take what is more beneficial for you.

The right consideration? Yes, in my opinion, this new tax slab duty is the most complicated tax slab rate ever introduced by any government. Now a lot of people will be in a dilemma as to which one to use, how to connect with existing headaches for taxpayers to save more taxes.

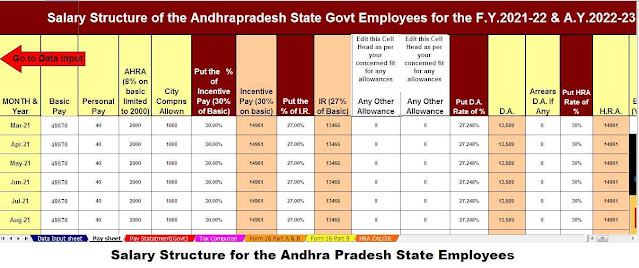

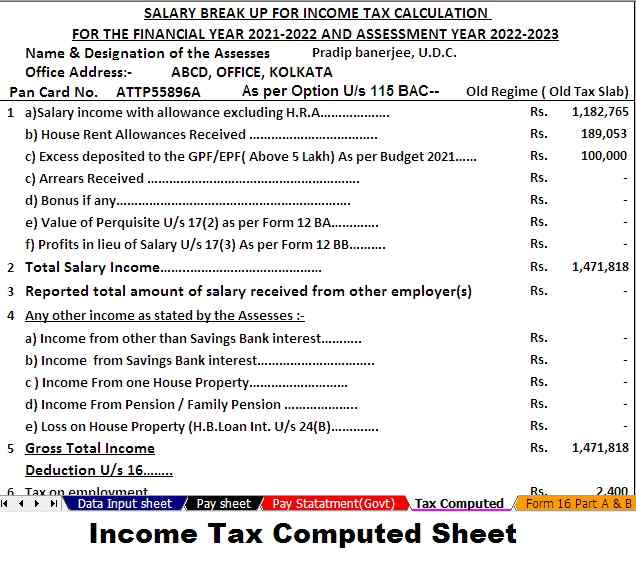

Feature of this Excel Utility:-

1) This Excel utility prepares and calculates your income tax as per the New Section 115 BAC (New and Old Tax Regime)

2) This Excel Utility has an option where you can choose your option as New or Old Tax Regime

3) This Excel Utility has a unique Salary Structure as per the Andhra Pradesh State Government Employee’s Salary Structure.

4) Automated Income Tax Revised Form 16 Part A&B for the F.Y.2021-22

5) Automated Income Tax Revised Form 16 Part B for the F.Y.2021-22