To avoid ancillary taxes, income tax planning takes time |What is a tax plan?

Effective tax planning and income management provide a healthy flow of white money that reflects the success of the economy. It benefits both citizens and the economy. Every taxpayer's money is dedicated to the betterment of the country.

How to save taxes?

Section 80C is a Unique category where a person can invest a maximum amount of Rs 1.5 Lakhs. Some of the commonly used investment/expenditure opportunities under section 80C is Employee Provident Fund (EPF), Public Provident Fund (PPF), Equity-Linked Savings Scheme (ELSS) Mutual Funds, National Pension System (NPS), Repayment home loan, children's school fees etc.

Section 80CCD (1B)

Deduction made available to additional Rs 50,000 in NPS. You may note that this deduction is available to you under Section 80C. In this way, you can save tax by investing up to Rs 1.5 lakh + 50 Thousand under Section 80C 80CCD & 80CCD(1B) up to Rs 2 lakh in a financial year.

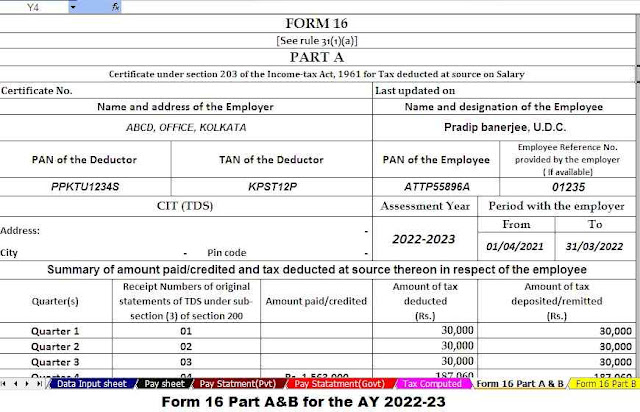

You may also, like- Automated Income Tax Form 16 Part A&B for the F.Y.2020-21 which can prepare at a time 50 Employees Form 16 Part A&B [Who are not able to download Form 16 Part A from the Income Tax Department Site TRACES, they can use this Excel Utility]

Section 80CCD (2)

This deduction is available for the employer's contribution to an employee's NPS account. A maximum contribution of 10% of the basic pay

The premium paid for the health insurance policy for self, spouse and dependent children up to Rs 25,000 can be claimed as exemption under Section 80D of the Income Tax Act. If your parents are senior citizens (60 years of age or older), this deduction will go up to a maximum of Rs 50,000. Therefore, self-paying health insurance premiums (including spouses and dependent children) and senior citizen parents can help you save up to Rs 75,000 in financial years.

Section 80DD and Section 80DDB

. Section 80 DD provides a tax break on the cost of treatment taken for a dependent disabled person. Dependents here include husband/wife, children, parents, brother and husband's sister.

Depending on the approved discount whether the dependent is disabled or severely disabled. If the dependent is at least 40% disabled, a maximum discount of Rs 75,000 can be claimed. On the other hand, if the disability is 60% or more, it is considered a serious disability and the maximum discount can be claimed which is Rs 1.25 lakh.

You may also, like- Automated Income Tax Form 16 Part B for the F.Y.2020-21 which can prepare at a time 50 Employees Form 16 Part B

Disability of 40% or more, you can claim an exemption under 80U Rs.75,000/- and for the above 80% Rs.1,25 Lakh. It is noted that now one can avail both exemptions U/s 80DD and U/s 80U.

Exemption claims under Section 80U are claimed by persons with disabilities and exemptions under Section 80DD are claimed by dependents bearing the cost of treatment of persons with disabilities.

You may also, like- Automated Income Tax Form 16 Part B for the F.Y.2020-21 which can prepare at a time 100 Employees Form 16 Part B

Interest on housing U/s 24 (B)

Anyone can claim tax benefit above a maximum of Rs 2 lakh on the interest paid on the loan in the financial year. If you are paying interest on a home loan for an under-construction property, this benefit will be available after the house is occupied, but it happens within five years.

If you have taken a home loan to buy a house under the Affordable Housing Department for the financial year 2010-2011, you can claim an additional tax deduction as an interest, a maximum of Rs 1.5 lakh.

Exempted Interest earned in savings accounts in banks or post offices Maximum Rs. 10 thousand.

Senior citizens (Aged 60 years and above) can claim a maximum rebate of Rs 50,000 from the total income under this section. The deduction can not be claimed both section 80TTA and 80TTB

Tax planning is not a day job and should be driven by considering financial goals, liquidity position and taxability on returns. Taxes A taxpayer can save tax and create wealth as well as plan ahead.

Feature of this Excel Utility:-

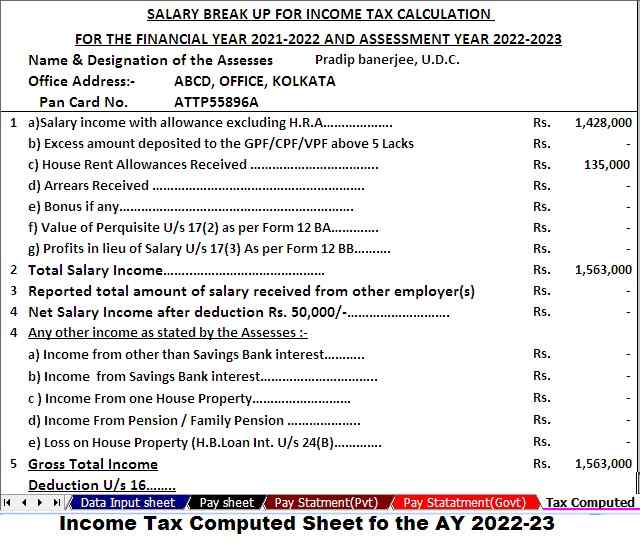

1) This Excel utility prepares and calculates your income tax as per the New Section 115 BAC (New and Old Tax Regime)

2) This Excel Utility has an option where you can choose your option as New or Old Tax Regime

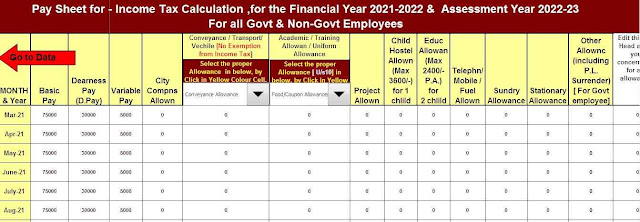

3) This Excel Utility has a unique Salary Structure for Government and Non-Government Employee’s Salary Structure.

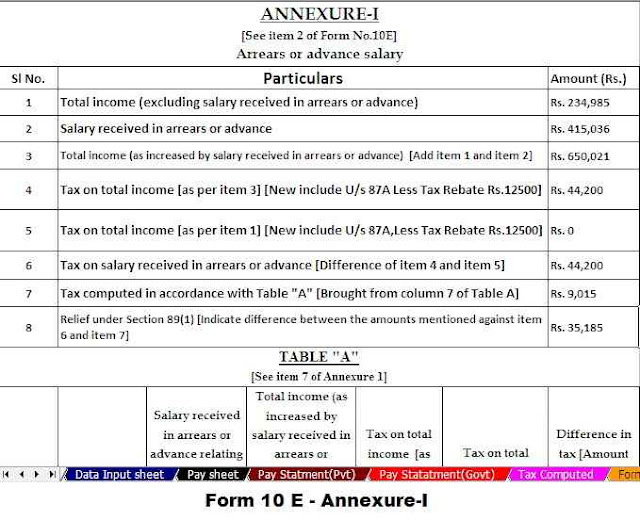

4) Automated Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the F.Y.2000-01 to F.Y.2021-22 (Update Version)

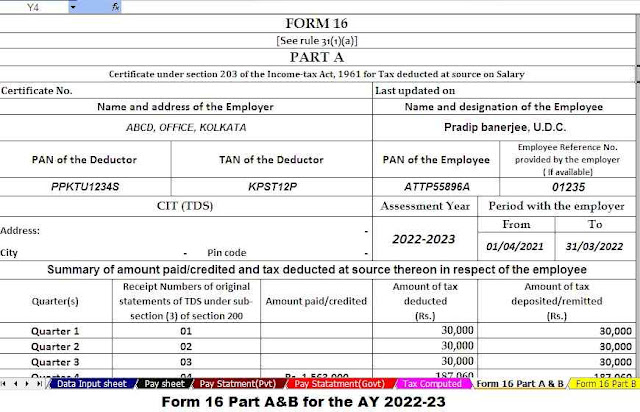

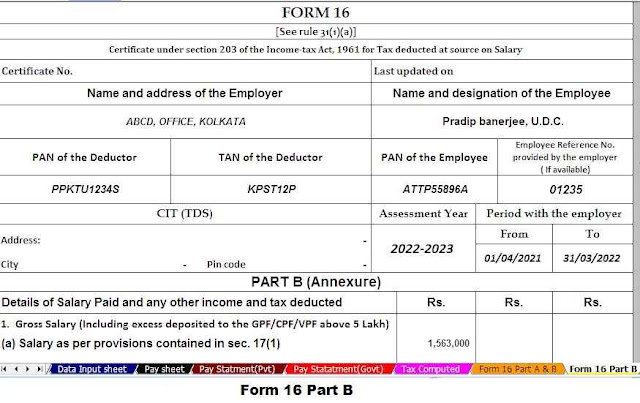

5) Automated Income Tax Revised Form 16 Part A&B for the F.Y.2021-22

6) Automated Income Tax Revised Form 16 Part B for the F.Y.2021-22